Which Life Insurance Plan is Best for YOU?

Let's find it out!

Choosing the right plan can be a daunting task. There are so many options that you can't help but feel drained trying to narrow it down to one that's right for you. We help you figure out the best option to go with by using proven strategies.

What makes it so challenging?

- There are 24 life insurance companies providing thousands of insurance plans. It's natural to feel overwhelmed by the abundance of choices, leading to either unsuitable selections or delaying the decision altogether.

- You've might have already visited insurance comparison websites. While these platforms let you compare products from all companies in one spot, it can be challenging to apply the right filters to narrow down plans that truly suit your requirements.

- You may have come across insurance blogs or articles (online or offline) that bombard you with complex technical terms, leaving you feeling confused and overwhelmed.

When you visit and purchase from these comparison sites, some of the most important factors in choosing the right plan are often overlooked or ignored.

The most common difficulties you face while buying a plan are.

What type of plan I should buy?

What is the ideal amount of insurance I should buy?

Which plan best suits my requirements?

Is there a Solution?

.

.

.

.

.

.

.

.

.

.

.

YES!

However, you might have been looking for it in the wrong place.

You might have a friend or a relative who is a part-time insurance agent

who lacks expertise.

OR

Your Bank’s Relationship Manager might be trying to sell you a plan

which serves no purpose but to meet his/her sales target.

OR

You might have visited a comparison website and felt either

overwhelmed by the number of options or felt clueless about the filters

you need to apply.

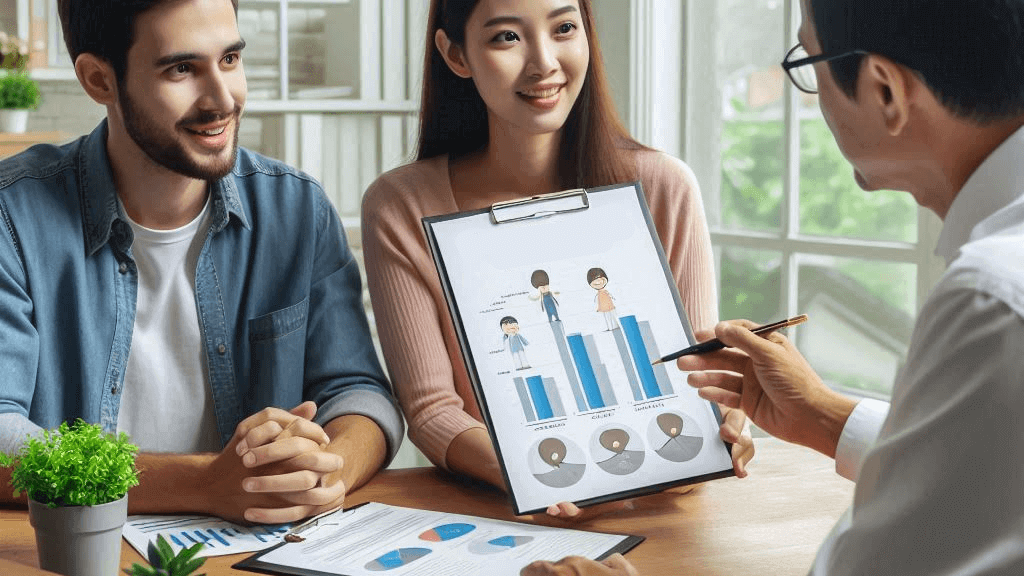

We at Secure My Wish, have developed a process that primarily focuses on two things.

- Understanding your needs:

This is usually ignored but a very critical step. In this step we take into consideration your short-term as well as long-term financial goals, evaluate your liquid assets and your current liabilities, and carefully assess your insurance needs.

Once we calculate the amount of insurance needed which can bridge the gap between your assets and liabilities if something were to happen to you, the next step which is equally important is to find the right plan or a combination of multiple plans (solution).

- Finding a plan that perfectly matches your needs:

The primary objective of an insurance plan is to protect our near and dear ones in case of an eventuality.

That is why we strongly recommend a term plan if the amount of insurance cover needed is very high since term insurance is very cost-effective for you to get adequate cover.

Once you have adequate insurance cover we also try to address other areas of concern you may have about your long-term financial goals such as your daughter’s marriage or your son’s education etc.

Some of the key elements of the process that we follow are:

Comprehensive Need Analysis: As an expert, we think it is our responsibility to educate you about what life insurance can do for you and also what not to expect from life insurance.

Decoding Complexity: We try to avoid using technical jargon and simplify everything by focussing on clarifying the concepts.

Clarity and Transparency: You have a total understanding of WHAT you are about to buy and most importantly WHY you should buy it in the first place.

Unbiased Advice: While recommending a solution the only factor which is taken into consideration is your wellbeing.

You might have heard:

EVERYBODY NEEDS LIFE INSURANCE

.

.

.

.

.

.

.

.

.

.

.

WRONG!

You need Life Insurance ONLY if:

- You have dependants.

- You have unsecured liabilities such as home loans, business loan etc.

- You have specific financial goals such as son’s education, daughter’s marriage.

- You don’t want to rely on anyone post-retirement.

- You want to save tax.

You DON’T need Life Insurance if:

- You are a student (unless you have an educational loan).

- You are retired.

- You already have ADEQUATE insurance.

Who We Are

Secure My Wish is company established over a decade ago with a vision of helping people build tailor-made insurance portfolios, designed to meet their specific needs. We are currently managing insurance portfolios of 700+ happy & satisfied clients.

What Our Customers Say About Us!

Prathamesh Karnik

Social Media Manager

"Secure My Wish helped me understand exactly what I needed through their detailed need analysis. They recommended the perfect life insurance plan tailored to my family's needs. Truly a great experience!"

Sanchiti Adhikari

Flight Attendant

"I was confused about which life insurance plan to choose, but Secure My Wish's need analysis made it easy. Their expertise ensured I got a plan that fits my future goals perfectly."

Sanket Sharma

Data Analyst

"Secure My Wish provided outstanding service throughout the process. Their team was responsive and made sure all my concerns were addressed. I felt well-supported every step of the way!"

Frequently Asked Questions

Why should I choose you instead of other comparison sites?

Needs Analysis, the first step while choosing insurance, is often skipped when you visit a comparison site. Hence, the chances of buying the right policy are very slim. We've systems & processes in place that ensure your goals are always in alignment with our recommendation. Furthermore, we don't just help you during the initial stages - we believe in building strong, long-lasting relationships. So we're always there to assist you with any policy-related concerns that may arise in the future.

How many Life Insurance companies do you deal with?

We work with all IRDA-approved Life Insurance companies in India so that you have a wide range of products to choose from.

Do I need to pay any consultation fees?

No, you don't need to pay any consultation fees. We're an insurance broking firm that's authorized to distribute insurance products from IRDA-approved life insurance companies. We receive compensation from insurance companies based on the quantum of business we bring in for them.

Can the entire process be done online?

Yes. Because of pandemics, the past couple of years have forced most of us to adapt to new ways of functioning. To ensure that your safety is not compromised, we have adopted innovative technologies to go entirely digital.

What other products/services does your company currently offer?

We provide end-to-end life insurance solutions and wealth management through mutual funds.

Do you offer service to clients living in small cities?

Yes. We service clients all across India.

What if I am not satisfied with your recommendation?

Our process is very transparent and we try to simplify and make you understand that the rationale behind our recommendations to the best of our abilities. However, you are under no obligation to follow our advice.

Do you remind us to renew the policy?

Yes. We do. Once you buy any plan from us you can decide the frequency and mode (SMS / Whatsapp / Email) of reminders.